February 2013 Performance Update, Market Outlook & News

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

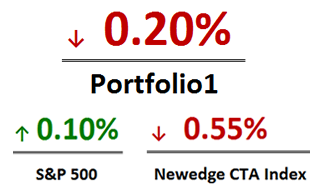

FEBRUARY PERFORMANCE:

CLICK HERE TO DOWNLOAD THE UPDATED PORTFOLIO1 PERFORMANCE REPORT

FEBRUARY RECAP – THE VOL HEAD FAKE & TRAP

A 12% spike in the VIX at the outset of February shook our mean reversion systems out of their January slumber and gave us several trade setups in the early days of the month. The initial bump in volatility proved to be a head fake for our systems however, as the VIX dropped quickly back to a 12 handle for the next week of trading. Whenever there is a rapid expansion in volatility quickly followed by a contraction, it is difficult for Portfolio1 to adjust stops and targets appropriately to the market. Targets are set outside contracting ranges and a lack of follow through leads to choppy reversals. That can lead to draw downs.

An early VIX spike failed to follow through. Near the end of the month, VIX broke out, though it retrenched before closing.

This was the case this month as we went straight into a draw down at the outset and had to fight all month long to get back to nearly break even for the month. Toward the end of the month, the expansion in volatility came back strong with follow through. A nearly 36% rise in the VIX sustained higher vol levels, which allowed us to claw back earlier losses in the month. Given what we ‘stepped in’ in the first week of the month, closing down two tenths of a percent did not feel too bad to us.

LOOKING AHEAD

The sequester happened and the Earth did not collapse into a black hole, though you would not know that if you listened to some of the more excitable deficit doves in DC. For all the nonsense of late, it appears that the US has done what Europe cannot seem to grasp: actual austerity. That means tax hikes AND spending cuts, not tax hikes and future spending cuts that never, ever materialize.

CLICK TO ENLARGE

VAMI since inception for RCM’s Portfolio1 against the S&P 500 price return and the Newedge CTA Index.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

To be sure, the sequester cuts are laughably modest and, by their nature, do nothing to slow the growth of entitlement spending which is where the real debt Armageddon lies. It is more instructive of how difficult real reform will be. The sequester was a very modest cut in the enormous expansion in baseline spending which is now the norm since Obama took office. Despite its modesty, the sequester elicited cat calls of economic disaster along with threats of shutting down military operations and turning out the prisons. Imagine what those same folks will be saying when the big three (Social Security, Medicare & Medicaid) come under the knife.

Without another man-made political and economic crisis on the horizon, equity markets will have to focus on other things. We do not buy the ‘money coming off the sidelines’ argument. Almost every meaningful economic indicator is in decline or showing contraction. Central banks are out of ammo and a currency war is under way. Equities get it last. The market is ripe for a correction, but it is tracking its pattern of the last four years. A peak should appear in the next 60 days, most likely in April. Until then, the markets will look for any reason to make new highs.

RCM NEWS

CFTC Rules & Letter

The CFTC held a hearing regarding its new customer protection rules. I had the opportunity to testify and offered up my two cents in the form of a letter requesting that they do not proceed with the implementation of these rules. Some of the rules represent a radical shift in the way the industry operates, which I believe would be detrimental to customers and FCMs alike. The net effect would be to ask customers to double down on a system they believe does not secure their property effectively.

John L. Roe comments next to Todd Kemp of the National Grain and Feed Association at the CFTC Roundtable on Customer Protections.

The most controversial of the CFTC’s proposed rules are those which govern residual interest and the rules for the treatment of margin calls by the FCM on behalf of its customers. ‘Residual interest’ is the amount of capital the FCM maintains in its segregated omnibus accounts where its customers’ money is held. The new rules would force FCMs to maintain a residual interest totaling all of the debits in customer accounts. The new margin rules would mean that FCMs would start taking capital charges after margin calls which are not met by their customers after the first day.

It appears that the CFTC has the noble goal of making it very difficult for the FCM to use customer property for another purpose than as it is intended. While I support the goal, this is not the way to accomplish it. However, their means to do this would force FCMs to require more money from their customers. Actually, FCMs will require a great deal more money from their customers: over $80 billion added to the system according to one analysis. Customer should not be asked to double down on the current system. Read my letter for more on the unintended consequences of the new rules.

We are tracking these rule changes very closely and will update you as to any developments. For those of you interested in treating yourself to 8 hours of dense testimony, feel free to watch the hearing recordings. 😉

Roundtable Video Part 1 | Roundtable Video Part 2

Corzine Push

As I noted last month, one of the first things I wanted to accomplish as a board member of the NFA was to have the Business Conduct Committee file charges against Jon Corzine. The New York Post was the first to report widely on this effort, though I first put forth the idea back in November of 2012. While there are many other matters which are much more pressing before the NFA, I campaigned on this issue and promised to bring this to the NFA’s attention.

After the first board meeting for the newly elected Board of Directors, the NFA issued the following statement:

The Board notes that Mr. Corzine is not currently a member of NFA. The Board is aware of publicly available information that raises issues concerning Mr. Corzine’s fitness for NFA membership. If Mr. Corzine applies for membership in the future, he will not be granted membership unless NFA, after completing its fitness investigation, resolves those issues to its satisfaction. Once the appropriate agencies have completed their investigations, NFA has the authority to bring disciplinary action against Mr. Corzine for violations of any NFA rules that occurred while he was a member. The sanctions for disciplinary actions could include a lifetime ban and significant monetary fines.

Statement from Chris Hehmeyer, Chairman of the NFA Board of Directors

This combats the notion that Mr. Corzine will find it easy to step back into managing money, as it has been floated in the New York Times and Wall Street Journal. What is painfully clear after this effort is that the Department of Justice is holding up the show. It is time for the DOJ to lead, follow or get out of the way on Corzine. If they are not going to take action, they should clear the way for regulators and state authorities to use the tools at their disposal.

Insurance/Customer Protection Fund Survey

The Commodity Customer Coalition launched a two part survey I authored on commodity account insurance. The surveys are intended to measure market sentiment and gather data to help determine the feasibility of my private commodity account insurance proposal, the Commodity Insurance Corporation. One survey is intended for NFA members and the other is intended for public commodity customers.

Each survey will gather data critical for modeling insurance, as well as determining pricing and the market’s desire for commodity account insurance. I need your help to complete these surveys. It is essential that we capture a large sample size to increase the accuracy of the data. Please participate in one or both of these surveys and encourage your friends and colleagues with commodity accounts or who work at NFA member businesses to do the same. The more responses we get, the more accurate our actuarial model will be. The data submitted will remain anonymous and will only be presented on an aggregate and anonymous basis.

As a way for the CCC to say thank you for completing this survey, each respondent will be entered into a random drawing for one of several $25 Amazon gift cards. The drawing will be held at the end of the survey period and the winners will be notified by email at the email address submitted with the completed survey.

* NFA Member Survey – for IBs, CTAs CPOs *

CLICK HERE TO LAUNCH SURVEY

* Public Commodity Customer Survey *

CLICK HERE TO LAUNCH CUSTOMER SURVEY

The CCC has proposed a private mutually owned insurance company that NFA members and their customers could opt into. If you would like to know more about the CCC’s plan for insurance, check out our presentation on our private insurance model. For an overview of the various insurance related studies and proposals floating around the industry, read this dispatch from Reuters.

MF Global Update – Liquidation Plan Proposed

The Trustee for the Chapter 11 proceeding of MF Global’s parent company (MFGH) has put forth a liquidation plan for the holding company and its affiliates which is being voted upon by creditors this month. Customers of MF Global’s defunct brokerage subsidiary, MF Global, Inc. (MFGI), will find this passage from the plan quite interesting:

The Plan Proponents have prepared a recovery analysis with respect to the MFGI estate estimating a 100% recovery to all MFGI customer claims and a 28.3% – 79.6% recovery to holders of general creditor claims against MFGI.

Page 44

The plan comes on the heels of the SIPA Trustee’s settlement agreement with MF Global’s parent and UK affiliate settling all claims between the entities. Basically, the settlement agreement and liquidation plan permit MFGH to loan MFGI the funds necessary to make customers whole. The plan met with initial resistance from MFGH’s largest creditor, JPMorgan. However, court ordered mediation settled JPMorgan’s dispute with the liquidation plan by subordinating about $275M of an inter company claim between MFGH and MFG Finance to the lenders of the credit facility under which it is subordinated. This settlement will result in a slightly modified range of recoveries for unsecured creditors of MFGH, but is not expected to change the recovery range for customers and creditors of MFGI. The amended liquidation plan will be filed with the court shortly.

The settlement between MFGH and JPMorgan removes the largest hurdle for the liquidation plan. Payments for customers could be distributed fairly quickly if the plan is approved. General creditors of MFGI still await the claim determination process. The vote on the liquidation plan is scheduled to close and be tabulated by April 2, 2013 and will be submitted to the court in a hearing scheduled for April 5, 2013.

Should it go through, a 100% recovery for commodity customers–which I have maintained is merely a matter of time since day 1 of this debacle–is in the bag. Watch our Twitter feed for updates intra month on this.

PFG Update – the Taxman Cometh, But in a Good Way

I am pleased to announce that the IRS will be issuing some guidance for PFGBest customers on the treatment of their tax losses. While I am not entirely sure what that guidance will be, I think the IRS may permit PFGBest customers to treat some or all of their losses resulting from Mr. Wasendorf’s fraud as a theft loss using the Revenue Ruling and Revenue Procedure enacted for Ponzi schemes after the Madoff crime. It appears that the IRS intended that Revenue Ruling and Procedure to be inclusive of many different forms of financial fraud, so that it would not have to issue special procedures and rules every time some crook absconds with customer property. There was a question though as to whether or not the fact pattern of the PFGBest fraud met the criteria they had in mind for claiming theft losses.

The CCC requested guidance from the IRS as to whether or not PFGBest customers could use the Madoff rules and procedures on their taxes. We have been in communication with the IRS and have worked to educate them on the PFGBest case. We have been informed to expect a response from the IRS around March 22, 2013. Watch our Twitter feed for updates intra month on this as well.

Theft loss treatment was not available for MF Global victims, as there has not yet been a criminal fraud charge or conviction in the case (thanks again, DOJ). Of course, given the pending 100% recovery, a theft loss was not necessary.

Upcoming Events

March 13, 2013 – Panel on Customer Protections – FIA Boca – I’ll be speaking on the customer protections panel Wednesday March 13th at 3:30 PM EST.

March 17-19, 2013 – National Grain and Feed Association Annual Convention – I’ll be speaking at the risk committee meeting on Sunday March 17th–Happy St. Patrick’s Day!

Until next month…

DISCLAIMER

Commodity trading, managed futures and other alternative investments are complex and carry a risk of substantial losses. They are not suitable for all investors. For a more detailed list of the risks involved in an investment with Roe Capital, please review our disclosure document. Data and graphs included herein are for educational and illustrative purposes only. Opinions expressed are that of the author and do not constitute tax or legal advice. Past performance is not indicative of future results. No market data or other information is warranted by Roe Capital Management as to completeness or accuracy, express or implied, and is subject to change without notice.