January 2013 Newsletter: RCM Performance Update, Market Outlook & News

JANUARY 2013 PERFORMANCE UPDATE

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS

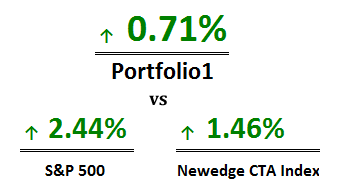

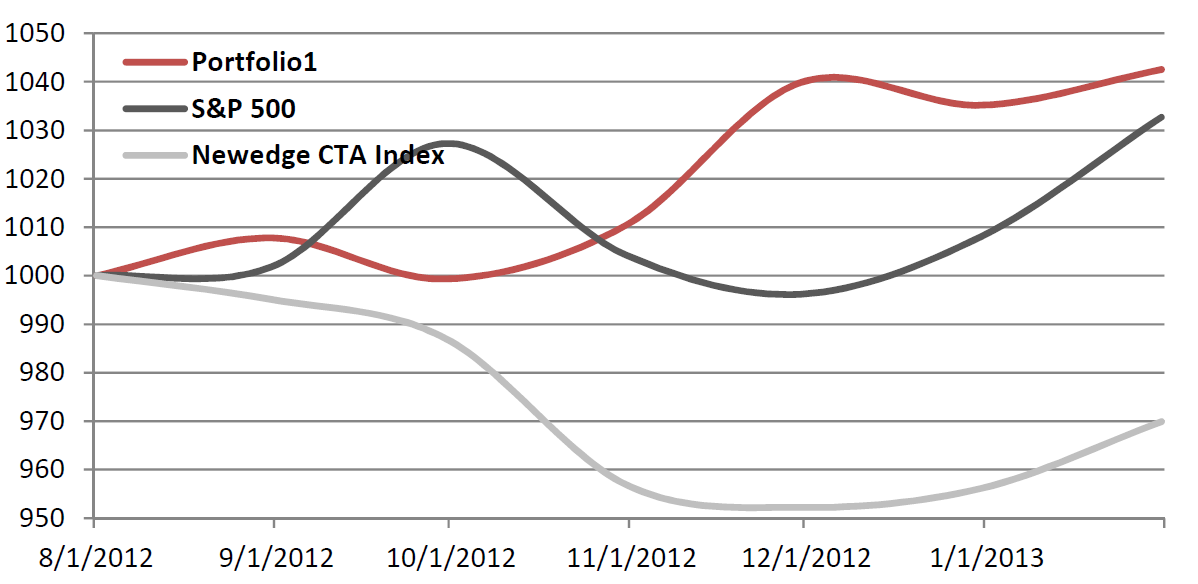

Portfolio1 ended the month of January 2013 up 0.71%, in a month characterized by low volatility with few trading opportunities. Tight ranges in the S&P 500 and equity prices grinding higher resulted in Portfolio1 taking small positions and making small gains. A little volatility goes a long way with Portfolio1 and this month there was too little volatility to post a larger gain. Nonetheless, we benefited from small trades with tight risk and put a green number on the board. Given the trading opportunities of the month, we are very pleased with the result.

Roe Capital’s Portfolio1 against the S&P 500 and Newedge CTA Index since inception. Past performance is not necessarily indicative of future results.

The January Effect

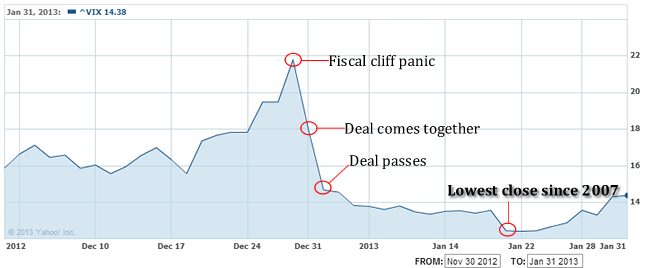

The VIX peak on fiscal cliff woes in late December reversed and the VIX plummeted to a close of 12.43 on January 22, more than a 40% correction from the fiscal cliff VIX peak. The VIX has not posted a 12 handle since 2007 (cue flash of lightning and clap of thunder). Of the 22 trading days in the month of January, 20 of them posted trading ranges in the S&P 500 under 1%. In fact, if we exclude the first and last day of the month, the S&P 500’s average daily trading range was 0.61% or about 9 points between the high and the low. That does not leave much room for a systematic day trading program to generate a return. As we noted above, given the lack of volatility, we are pleased with our January 2013 performance.

As such, Portfolio1 was outperformed by equity indexes in the first month of the year. Some have labeled the propensity for a start of the year equity rally the ‘January Effect,’ a rally resulting from funds flowing into equities. Apple’s decline and its effect on the NASDAQ notwithstanding, broader indexes were much higher in January, led by small caps. The Russell 2000 is up nearly 20% since its November lows. While we would not call this a bubble, there is certainly room for a correction.

Our managed futures peers bested us as well in January, as energy and currency markets surged. The Newedge CTA Index closed up 1.46%, though Portfolio1 remains ahead since inception.

Looking Ahead

February looks light on economic data, so we expect a slow month until the market goes on DC watch again as we near the newly minted ‘sequester cliff’ approaching March 1. We anticipate debate over sequestration will give the media plenty of high drama, which should bring some volatility back into equity markets just as the fiscal cliff fiasco did in December. Expanding volatility means expanding risk, but with that more trading opportunities for Portfolio1.

RCM NEWS

Moving & Shaking

I’d like to thank Futures Magazine for naming me among the top 20 movers and shakers of 2012. It is quite an honor and one I am grateful for receiving. It certainly did not escape me that they placed me just ahead of JPMorgan’s Jamie Dimon. I only wish I received that ‘uh oh, the boss is here’ look he gets when he testifies before Congress. Futures Magazine’s coverage of derivatives markets is second to none, exemplified by their reporting on the MF Global and PFGBest crises.

Our ‘friend’ Mr. Corzine was also on Futures Magazine’s list. I hope by this time next year we can remove him from it for good.

NFA Election

I am pleased to announce that my bid to represent CTAs and CPOs to the NFA Board of Directors was successful. I would like to thank those who supported my candidacy, as well as the outgoing members of the Board for their years of service. NFA staff has been extremely helpful in bringing me up to speed on the bureaucratic machinery which directs the futures industry’s SRO, which I greatly appreciate as well.

I am taking special care to become familiar with the inner workings of the NFA, from its organization hierarchy to its committee structure. Achieving meaningful reform will require diligent deliberative efforts on the part of all those who represent their fellow registrants to the NFA. I am committed to bringing about reforms not only at the NFA, but in the industry at large. I welcome all who will commit to aiding this process, regardless of their viewpoint.

In the very first Board meeting, I will address the one thing the NFA can do right now to affect justice for victims of recent FCM shenanigans: creating a consequence for violating NFA rules. The NFA owes it to commodity customers and its membership, especially those NFA members who remain incalculably damaged by MF Global CEO Jon Corzine’s infractions, to permanently bar him from membership and impose on him the maximum possible fine.

As NFA President Dan Roth noted in his testimony before the House Agriculture Committee, “one way to prevent fraud is to deter fraud through vigorous prosecutions of the laws that are on the books now.” Evidence is in the public domain of the most serious and unprecedented violations of NFA rules on the part of Mr. Corzine and MF Global. Regardless of the status of investigations of the alphabet soup of agencies investigating MF Global, the NFA has an obligation to respond now. I will recommend that the Board direct the NFA’s Business Conduct Committee to review the SIPA Trustee and House Financial Services Subcommittee on Oversight and Investigations reports on MF Global and take action.

From there, I plan to address a host of issues, from reforming the NFA arbitration process to redeveloping the audit culture of the NFA to formally recommending bankruptcy reforms to Congress. I look forward to playing a role in restoring customer confidence in the system from which we all derive our livelihood. Much is at stake, but much is possible now which was not in the past. I believe we can achieve the reforms the industry needs to survive and thrive.

MF Global Update

At a hearing on January 31, 2012, Judge Glenn approved the SIPA Trustee’s settlement agreements between MFGUK and MFGH. These settlements clear these affiliates’ claims on customer funds which were causing the SIPA Trustee to hold customer property in reserve. Furthermore, it paves the way for between $500 and $600 million to start coming back from MFGUK for customers with 30.7 balances in the US. The SIPA Trustee hopes that this will raise 4d recoveries from 80% to 93%, with initial 30.7 recoveries rising to 40% and then up to 80% depending on the total recovery from the MFGUK case. Distributions are expected to start immediately, taking place over a few months.

The Commodity Customer Coalition is concerned that this settlement may lead to making the shortfall for customers permanent and transfer the savings benefit from litigation expenses from customers to general creditors. Giddens’ settlement will certainly save on costly and lengthy litigation, but his settlement transfers the loss from legal fees from estate property to the customer pool. In other words, if the UK litigation took 4 years but recovered $700 million, then all $700 million goes back to customers in the 30.7 pool. Legal fees for that litigation are paid out of estate property. With the settlement, $500 million is returned to the 30.7 pool, $200 million less than is needed. Without a ruling on customer priority over estate assets, the resulting $100 to $200 million shortfall could be treated as a general creditor claim on the estate fund. The CCC filed a Response Brief on customer priority over a year ago on which the court has yet to rule. We are examining our options.

Courtroom sketch of PFGBest’s Russ Wasendorf as his sentence is handed down. Source: Wall Street Journal.

PFGBest Update

On a happy note, PFGBest crook Russ Wasendorf will likely spend the rest of his life in jail, receiving a 50 year sentence for defrauding customers. It is my understanding that Federal guidelines dictate that he will serve at least 85% of that time, meaning he is eligible for parole shortly after his 106th birthday. One down, one to go….

As of the most recent information publicly available, the Chapter 7 trustee retains around $58 million in undistributed 4d and 30.7 customer property. He has also marshaled around $45 million in forex and metals customer property and retains about $25 million in estate property. The Trustee continues to liquidate PFGBest assets, recently selling one some trading platforms and other proprietary products. The Trustee and the professionals the Trustee employed have filed fee applications totaling around $2.7 million for the first 6 months of the case and those applications are scheduled for a hearing in early February. The Receiver marshaled around $1 million in the December auction of Russ Wassendorf’s personal assets.

At issue in the PFGBest case is the treatment of forex and metals property: will these customers be treated as general creditors or will they be able to recover all of their funds traceable to their specific accounts? Forex customers and buyers of OTC metals (mostly bullion and coins at PFG) are not entitled to the segregation protections of the Commodity Exchange Act (“CEA”). On top of that, the priority of commodity customers over estate assets must also be resolved. A group of forex and OTC metals customers have filed a motion arguing that PFGBest acted as a fiduciary, had no interest in this property and therefore a constructive trust exists entitling forex and OTC metals customers to the segregation protections of the CEA. The Chapter 7 Trustee filed an objection to this motion which the Judge rejected at January 23 hearing.

Basically the judge in the PFGBest case is looking for a way to get forex customers treated the same way as commodity customers, which is to say exclusive access to their own pool of assets. Forex customers have a great case for a constructive trust, but constructive trusts are generally unenforceable when property is commingled (because it cannot be reliably traced). Also, as we have learned at the CCC, it is hard to overcome the Trustee’s powers to ratably distribute property, especially if doing so would favor one group of unsecured creditors over another. Therefore, the treatment of forex property is going to hinge on the Chapter 7 Trustee’s distribution plan and the judge’s view of its equity.

Ultimately, I think that the Refco case shows how this will play out. Since forex accounts at Refco were commingled, Refco forex customers got treated as general creditors and received a ratable distribution of all estate property with other general creditors. This is the most likely outcome for PFGBest’s forex and OTC metals customers.

The CCC continues to work with a few of its members and attorneys regarding obtaining guidance from the IRS on the possible treatment of losses from PFGBest as theft losses. We are asking the IRS what it is going to take to allow PFGBest customers to walk through the same door the IRS opened for victims of the Madoff scheme. This effort is underway and will take some time to obtain a result. Check our blog for updates on this issue.

Reform Update

The CCC is in the process of preparing its feasibility study on commodity customer account insurance. Over the course of the coming quarter, we will conduct this study in conjunction with an insurer to determine if there is sufficient market demand for our proposed captive insurance model. We are working with industry leaders to obtain funding for our study. If the study returns positive results, we will work with an insurance partner to model the insurance scheme. Assuming we are able to construct a cost-effective mechanism, we will begin the work of initiating the captive insurance company and offer account insurance for commodity customers.

The CCC remains in communication with members of Congress and staff on reforms impacting the safety of commodity customer funds. The newly sworn-in 113th congress welcomes many new members to whom we are reaching out in service of our agenda. We anticipate several reforms will be on the table during the re-authorization of the Commodity Exchange Act and plan to represent customer interests as that process unfolds.

Until next month…

DISCLAIMERCommodity trading, managed futures and other alternative investments are complex and carry a risk of substantial losses. They are not suitable for all investors. For a more detailed list of the risks involved in an investment with Roe Capital, please review our disclosure document. Data and graphs included herein are for educational and illustrative purposes only. Opinions expressed are that of the author and do not constitute tax or legal advice. Past performance is not indicative of future results. No market data or other information is warranted by Roe Capital Management as to completeness or accuracy, express or implied, and is subject to change without notice.